The "Perfect" Trade

Don't overthink it.

This week there was a perfect setup for an amazing trade, and I killed it.

No, actually, I completely botched it and actually lost money. Let’s walk through what happened.

The Setup

I wrote an overview about Mirror Protocol almost a year ago. Give that post a quick read if you haven’t been using Mirror Protocol, and then meet me back here…

Mirror’s governance decided to raise the minimum collateral ratio (MCR) for two mAssets, mSPY and mKO. It was previously at 110%, and was raised to 130%. That’s a level with greater safety for the protocol, but resulted in liquidations for any users with collateral ratios in that range. Since the liquidations would go through right at pre-market open after the change, there would be a big spike in mKO and mSPY trading prices, at a known time, for a very short window.

The Execution

Even though I knew that mKO had a lot more pending liquidations than mSPY, I split my position 60/40 between mKO and mSPY. Diversification, amiright?

I saw dollar signs, big payday, potential 25% move… so I locked all my mKO and mSPY into vaults, borrowed other mAssets against it, sold those into the market, and put on as much size as I could.

I had so much confidence in the trade that I took the 60% of my portfolio that I could liquidate easily and shift into this trade, and then levered it up 70%, so my total trade size added up to … 60% * 1.7 = 102% of my total portfolio. Highly confident, much size.

The Fallout

Pre-market opens at 4 a.m. in New York, and I was at my desk at 1 a.m. on the west coast, freshly brewed coffee, 3 hours of sleep.

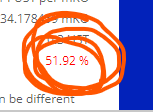

Pre-market opened, liquidations start to go through, and both mSPY and mKO spiked 25%, exactly as expected. But I had only $4000 of mSPY liquid and had to work through all my vaults, one at a time, to fully unwind the rest. Got 20% premium on the first couple of trades, great start… trades on terra taking 20-30 seconds (compared to normal 3-5 seconds), not very helpful…

I get through about 1/3 of my vaults with an average exit up 10-15% from my entrance price, which is a great beginning. But by that point all of the liquidations have worked their way through the market, and everyone that took an unleveraged trade has taken off their profits and started shorting because they expect the mSPY and mKO prices to revert back to a small discount to Oracle.

I get through half of my vaults, and the mSPY and mKO premiums have completely disappeared. I’m now at breakeven on my mSPY and mKO pricing, but i’m still paying closing fees for my borrowing, along with slippage on buying in my short positions that I used for leverage.

By the time I unwind everything, I’m down 5% overall. Since I was levered up to 102% of my portfolio, that means I’m down 5% on the week, after a ‘perfect’ trade!

Summary

I broke all my rules, and I turned a “perfect” 25% setup into a 5% loss.

If I followed my normal risk framework, I would have had about 20% of my portfolio on the trade, made about 25% on it, and walked away with a 5% increase on my total capital base!

If I put in 60% of my portfolio, but with no leverage, it could still have been a juicy 15% gain on the week.

Lessons

Lesson 1: stick to your risk framework

Lesson 2: don’t overcomplicate it

Lesson 3: don’t get greedy, it turns “smart” into stupid

Lesson 4: leverage changes the risk parameters of a trade - make sure you fully understand the impact, or don’t use leverage

Lesson 5: when a trade is still crowded, you have to time it perfectly or you can still get carried out

Lesson 6: a “perfect” trade is always crowded. You are not the only smart person in the room.

Lesson 7: aim small, miss small. Since you can’t time it perfectly, make sure that your size is manageable, so that you can at least get it close

Incidentally, I keep relearning Lesson 4… This should teach me something. Maybe I’m learning the wrong lessons from this. What do you think?

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Savage Corner writers hold crypto assets and actively trade in certain markets.

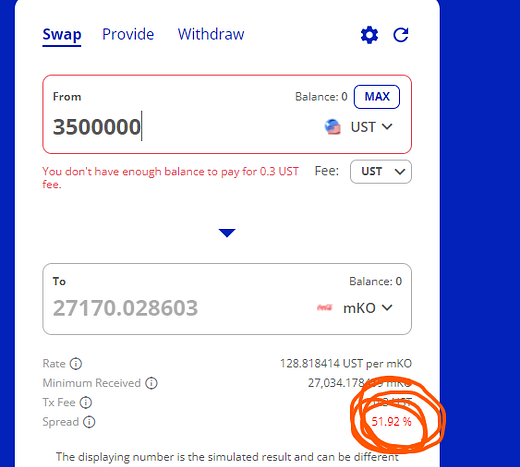

Thanks for this post. I found you on twitter and made it to your writing here. I unfortunately was the fool that was a part of the $3.5M in mKO. I am completely new to defi and gave it a go on what I thought was a very risk mitigated trade as described here: https://www.youtube.com/watch?v=azpE7tkcUyc

I thought the only thing I had to monitor was the price of mKO so that I would not be margin called. Little did I know that the community can change the rules right from under you. I can't help but feel like a victim despite knowing all of the usual disclaimers: highly risky, smart contract risk, UST peg risk...I guess I'll add governance risk to the list.

FWIW, I put our home refi money into this trade to get a quick gain before we needed the money. I was taking a short cut to improve our life. Now we are left with $0. Besides kicking myself and trying to explain this to my wife, do you know of any possible recourse? I know that someone previously proposed the community for reimbursement of another like event (https://mirrorprotocol.app/#/gov/poll/228) but to no avail. Do you think it's worth proposing? Do you think there are any sympathetic people in the Luna ecosystem that are worth reaching out to?

Anyhow, appreciate your writing and thoughtful tweets. I wish I was following you a week ago :)